CCH iKnowConnect – BEPS

Base erosion and profit shifting (BEPS) is one of the fastest evolving areas of international tax. CCH iKnowConnect allows tax professionals and advisors to efficiently research issues across over 60 jurisdictions.

Learn More

Seamlessly navigate through base erosion and profit shifting (BEPS)

Our in-depth coverage in CCH iKnowConnect has been designed for tax professionals and advisors to guide them through the complexities of BEPS. This is one of the fastest evolving areas of international tax, which includes the introduction of Pillar Two.

The BEPS practice area addresses the response of various jurisdictions to the OECD’s BEPS Pillar Two Action Plan.

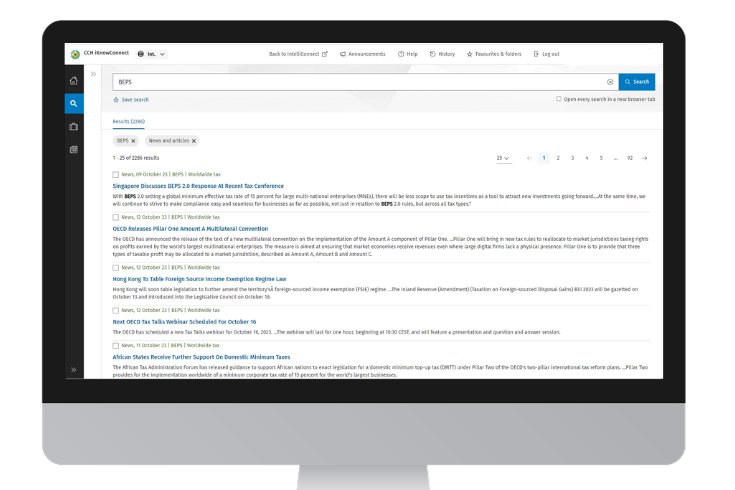

A faster, more accurate search experience

With content created for the online user, CCH iKnowConnect delivers curated search results so you can find the right answer faster, providing a more efficient research experience.

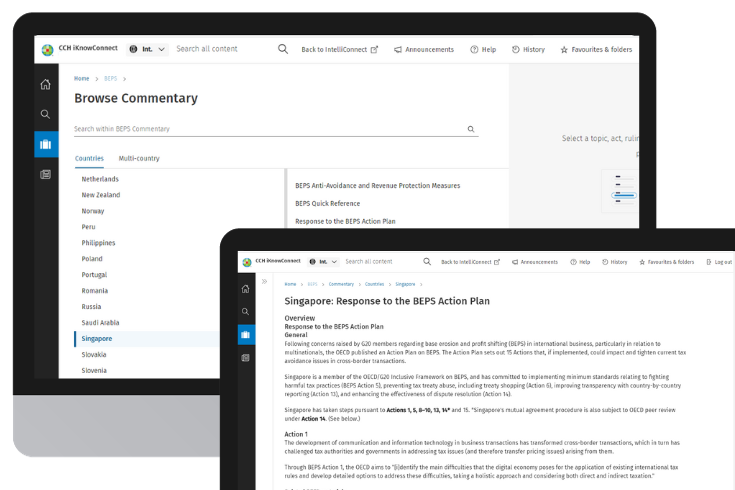

In-depth analysis and commentary

Our commentary is written by experts in the field and industry thought leaders. The BEPS practice area provides legal and practical analysis of the response of various jurisdictions to BEPS. Also included are the OECD’s BEPS Action Plan and related documents.

News alerts

Keep up to date with the latest news, as and when developments happen.

Tailor your news alerts so that you receive them direct to your inbox on a daily or weekly basis.

How to Subscribe ? Request for Free Trial / Live Demo / Quotation ?

Please contact:

Email: HK-sales@wolterskluwer.com

Call: +852 2110-3060