Kluwer International Tax Law

The leading research platform for international tax law professionals.

Access a wealth of cross-border international tax law materials, content, and practical tools

The content sets and user journey are aligned to that of a tax professional.

- Peer-designed intuitive user interface making it easy to compare core PE documents in line with tax professionals’ workflow

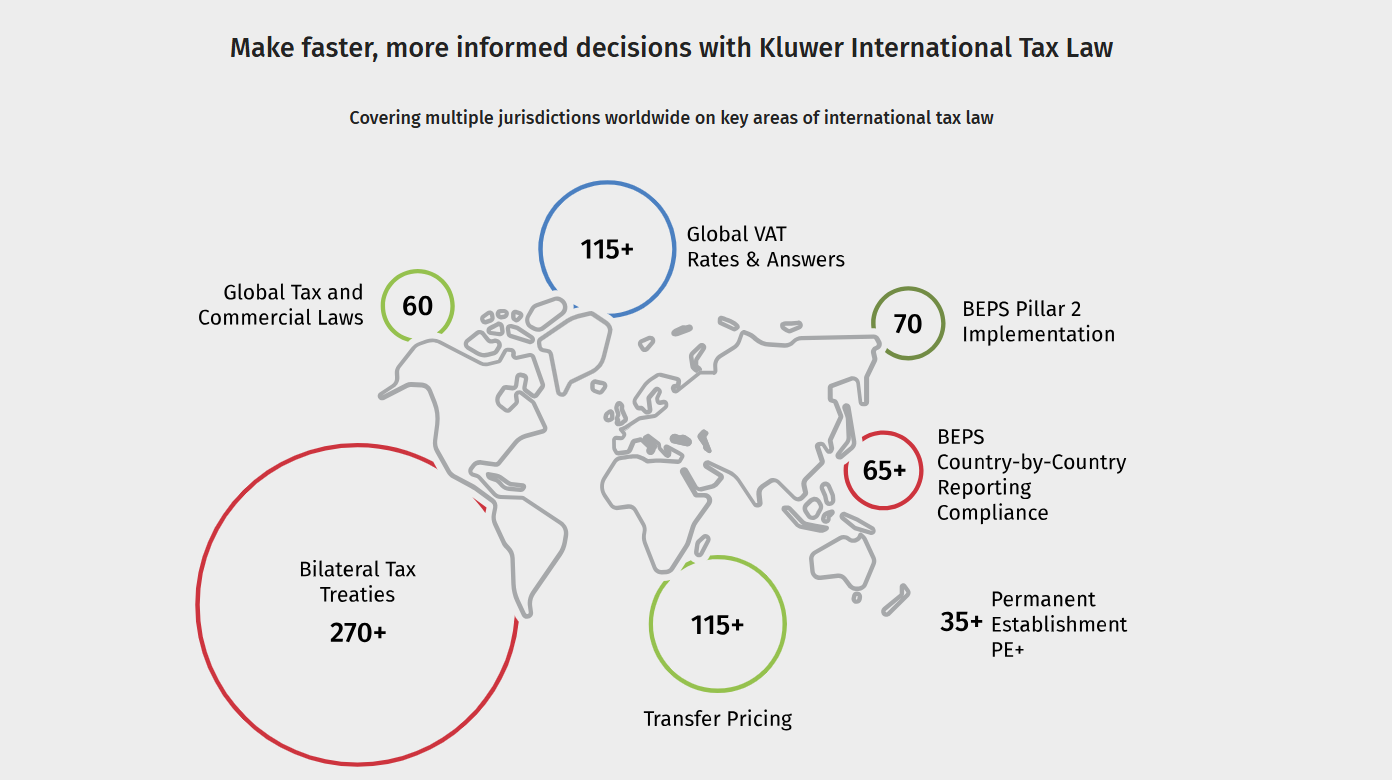

- Country-by-Country comparison of domestic PE regulations, currently covering 35+ jurisdictions

- Country reports; tax treaties, model conventions and commentaries; tax cases; journal articles, all interlinked

How to Subscribe ? Request for Free Trial / Live Demo / Quotation ?

Please contact:

- Email: HK-sales@wolterskluwer.com

- Call: +852 2110-3060